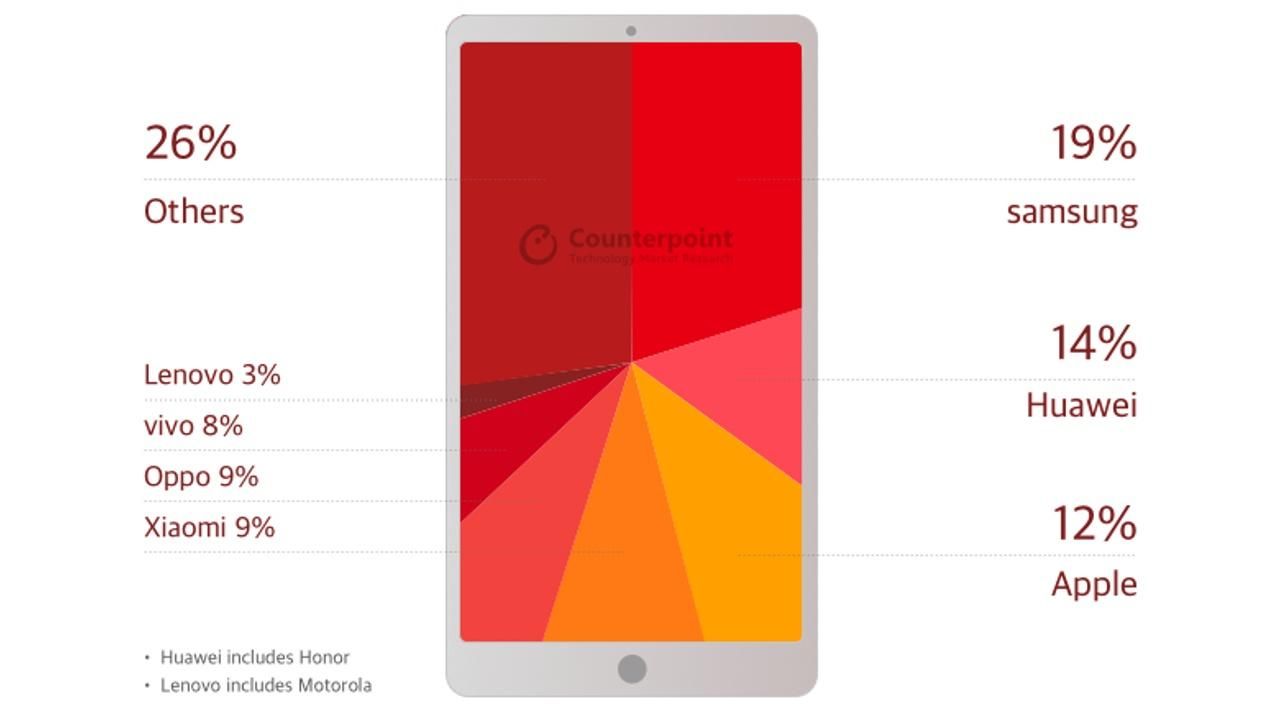

Samsung still leads much of the world in smartphone shipments while Huawei is gaining ground against its main rival. Meanwhile, while not in the top ranks, HMD Global has made the best gains in a shrinking smartphone market. Those were the top-line observations from Counterpoint Research for the third quarter.

Declines in shipments for the developed world were somewhat severe while growth in developing markets was subdued. This led to a 5 percent drop in shipments on an annual basis down to 380 million units.

The ten biggest manufacturers claim 79 percent of the market. Samsung took 19 percent globally and led in Latin America, Europe and the Middle East and Africa with 37, 31 and 25 percent shares, respectively. Raw numbers dropped in most markets except for India, where it recorded a record high.

Huawei, which includes its Honor subsidiary, came in second place with 14 percent around the world and placed second-best in Asia (behind OPPO), Europe and the MEA region. It grew shipments by 33 percent from last year.

In third, Apple clutched 12 percent and unit shipments remained flat.

[table]

Market,Global,Asia,North America,Europe,Latin America,Middle East and Africa

1,Samsung (19%),OPPO (16%),Apple (39%),Samsung (31%),Samsung (37%),Samsung (25%)

2,Huawei (14%),Huawei (tie / 15%),Samsung (26%),Huawei (22%),Lenovo (15%),Huawei (11%)

3,Apple (12%),vivo (tie / 15%),LG (17%),Apple (19%),Huawei (13%),Tecno (9%)

4,OPPO (tie / 9%),Xiaomi (14%),Lenovo (8%),Xiaomi (4%),LG (6%),iTel (7%)

5,Xiaomi (tie / 9%),Samsung (10%),Alcatel (5%),Alcatel (2%),Apple (4%),Apple (5%)

[/table]

In North America, Apple took 39 percent of shipments for the summer with Samsung at 26 percent, LG at 17 percent, Lenovo (Motorola being the primary brand) at 8 percent and Alcatel at 5 percent.

One more note: HMD Global, which runs Nokia’s smartphone operations, had a 73 percent year-over-year improvement.

More details and a full rundown on the growing feature phone market can be found at the source link below this story.