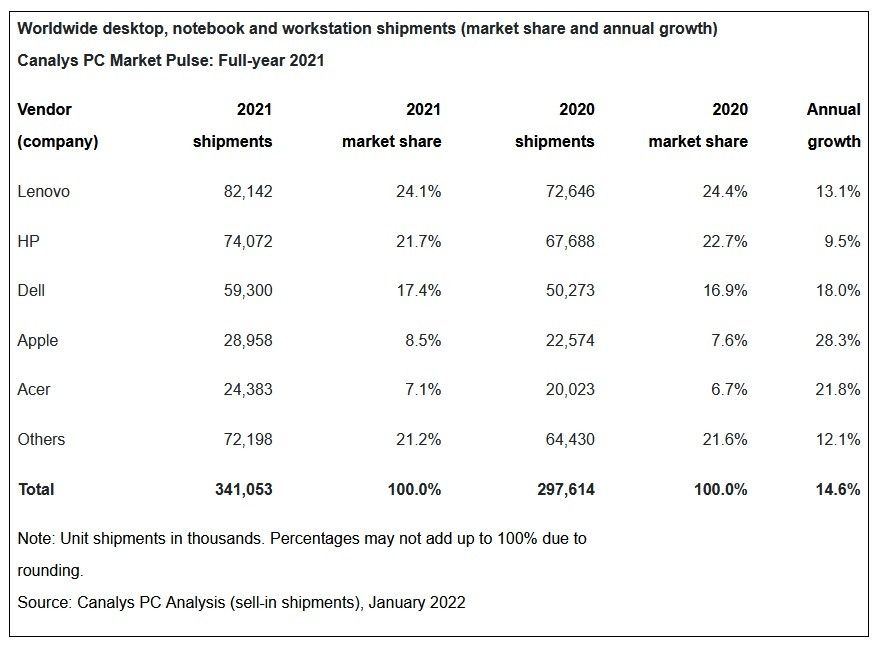

Apple has made a massive impact on the tech world thanks to its proprietary silicon. Cupertino started to see its Mac sales skyrocket since the launch of the original M1 trio, which includes the 13-inch MacBook Pro, MacBook Air, and Mac mini. However, Apple’s success doesn’t stop there as the company has released more processors and Mac models, including the 24-inch iMac and the latest and most potent 14 and 16-inch MacBook Pro models that now feature Apple’s most powerful chipsets yet. These latest models have helped boost Apple sales even more, and it seems that this trend won’t stop anytime soon, as the latest report from Canalys shows that Mac shipments have reached an annual growth of 28.3 percent compared to the 14.6 percent growth of the global PC market.

Source: Canalys

A couple of months ago, we received information from Ming-Chi Kuo suggesting that “the shipment of Apple Silicon processor-based MacBook models will be cut by approximately 15% in 1H22 and attribute it to three reasons: 1) component shortages, 2) structural demand change in the post- COVID-19 era, and 3) product transition between legacy and new models.” However, we are living the first weeks of 2022, and Apple’s shipments just keep getting better. The pushing force behind these amazing sales numbers is Apple’s silicon, more importantly the latest M1 Pro and M1 Max processors that were announced back in October, powering the latest 14 and 16-inch MacBook Pro laptops.

The PC market ended 2021 with a bang, as fourth-quarter shipments exceeded 90 million for the second year in a row. The latest Canalys data shows that worldwide shipments of desktops, notebooks and workstations grew 1% year on year to 92 million units over 91 million a year ago.

This pulled up total shipments for full-year 2021 to 341 million units, 15% higher than last year, 27% higher than 2019 and the largest shipment total since 2012. Furthermore, the industry saw strong revenue gains, with the total value of Q4 shipments estimated at US$70 billion, an annual increase of 11% over Q4 2020. For the full year, revenue passed US$250 billion in 2021 against US$220 billion in 2020, up 15%, highlighting the seismic transformation in the industry.

The two-year compound annual growth rate of 13% from 2019 emphasizes how dramatically the importance of PCs has grown since the onset of the COVID-19 pandemic. Notebooks and mobile workstations continued to lead the charge, with shipments of these devices growing 16% in 2021 to reach 275 million units. Desktop and desktop workstation shipments increased 7% in 2021 to reach 66 million units.

Canalys' Principal Analyst Rushabh Doshi also said that:

“While 2021 was the year of digital transformation, 2022 will be the year of digital acceleration.”

“Demand for technology has boomed in the past two years, the effects of which continue to disrupt the supply chain, affecting not just availability of PCs, but also smartphones, automobiles and servers. As PC vendors navigate an ever more complicated situation, consumer spending patterns are shifting. We will see revenue growth in the industry from spending on premium PCs, monitors, accessories and other technology products that enable us to work from anywhere, collaborate around the world and remain ultra-productive. The importance of faster, better, more resilient and more secure PCs has never been greater, and the industry is willing to innovate and push the boundaries to keep this momentum going.”

So now, we will have to wait and see if Apple can maintain this pace, of if its shipments numbers eventually get hindered by chip shortages and the ongoing pandemic.

Source: Canalys