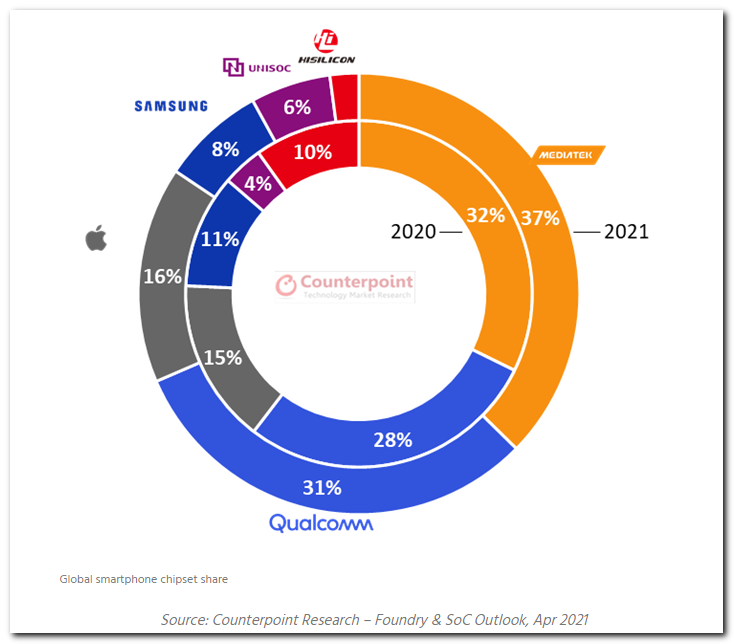

MediaTek has played second fiddle to Qualcomm for a while now, but the latest industry trends suggest that the company will ride its recent growth momentum and maintain its lead over Qualcomm in 2021. As per a report by Counterpoint Research, Mediatek will likely end the year with a 37% share of the global smartphone SoC market, leading Qualcomm by a healthy margin. This marks a 5% growth in the market share on a YoY basis compared to 2021.

Qualcomm, on the other hand, will take the second spot with a market share of 31% in 2021, up 3% when compared to 2020, while Apple is poised to take the third spot with a 16% market share. Even though Samsung’s market share will be far less at just 8% by the end of the ongoing year, it actually amounts to a healthy 100% growth on a YoY basis.

MediaTek is fast catching up to Qualcomm in the domain of 5G chips too

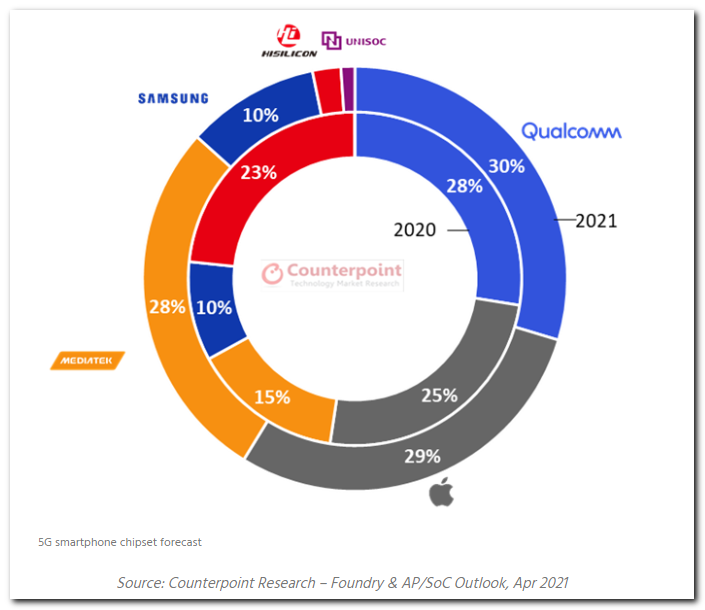

The market duopoly of MediaTek and Qualcomm reverses when it comes to 5G smartphone SoCs. Qualcomm is expected to end the year with a market share of 30%, up 2% compared to 2020. The company will see its shipments go up as it expands 5G support to even the low-end Snapdragon 400-series SoCs, after giving the same treatment to Snapdragon 600-series and Snapdragon 700-series over the past few quarters.

MediaTek, on the other, is poised to end 2021 with a market share of 28%, which is actually a huge growth compared to the 10% market share it commanded last year. The company has lately added multiple 5G-ready Dimesity-series SoCs to its portfolio, and they have been lapped up by top Chinese smartphone makers. Apple makes things interesting here by taking the second spot in the global 5G smartphone SoC market with a share of 29% by the end of 2021.

Looking at it from a wider perspective, MediaTek appears to be the winner here, especially when it comes to growth in market share over the past 12 months. Chipsets based on the 5nm, 6nm, and 7nm will contribute to almost half of the global smartphone SoC shipments in 2021, especially for 5G smartphones. Of course, the predictions might change down the road keeping in mind the ongoing global semiconductor shortage, and how it affects the supply chain dynamics between these vendors and their manufacturing partners that include the likes of Samsung and TSMC.