It is no secret that the US trade sanctions have had a serious impact on HUAWEI’s smartphone business. En route to global smartphone dominance not too long ago, the company is now struggling in its own home market, and a key reason for the lost market share was the inability to sell 5G phones across different price brackets in a market where 5G phones sold more than 4G devices last quarter. Reeling from the lost revenue. HUAWEI has now announced that it will charge smartphone makers a royalty fee for accessing its 5G patents.

In an official press release, HUAWEI says that it will charge a royalty fee of $2.5 per device to smartphone makers for accessing its 5G patents. Jason Ding, Head of Huawei’s Intellectual Property Rights Department, estimates that the company will make somewhere in the ballpark of $1.2 billion to $1.3 billion between 2019 and 2021 by licensing its patents. However, what share of it comes from 5G SEP (Standard Essential Patent) has not been revealed.

Despite dominating the 5G patent race, HUAWEI is charging a lower fee than its rivals

HUAWEI has the largest collection of 5G patents in the world, far ahead of rivals such as Nokia, Qualcomm, and Ericsson. But compared to the aforementioned companies, HUAWEI is charging the lowest 5G patent licensing fee, over 40% less than Nokia and almost a third of what Qualcomm asked for.

READ MORE: US further chokes HUAWEI’s access to 5G. What that means for its phone biz?

While the 5G patent licensing fee has been set at $2.5 for smartphones, the company will put negotiable rates on the table for other classes of equipment, ranging from cars to home appliances. The company says it aims to bolster the adoption of 5G by charging a ‘reasonable’ fee. But in the hindsight, the strategy can prove to be a critical source of revenue for the company which has been hit by US sanctions, with the pandemic further adding to the woes.

What are these 5G patents?

Image: HUAWEI

In simple words, when a new generation of cellular connectivity is being developed, standards are created that allow phones to latch on these networks and enable global interoperability. When the standards are being set, companies like Qualcomm, HUAWEI, and Ericsson participate in the process and also come up with new technologies that they can patent in their name.

These patents form a critical component of how these next-generation cellular connectivity standards – 5G in this case – will work. And that’s why they get their name – SEPs, which is short for Standard Essential Patents. HUAWEI is licensing its 5G SEPs for use in smartphones made by the likes of Apple and Samsung, in exchange for a royalty fee.

Where does HUAWEI stand in the 5G race?

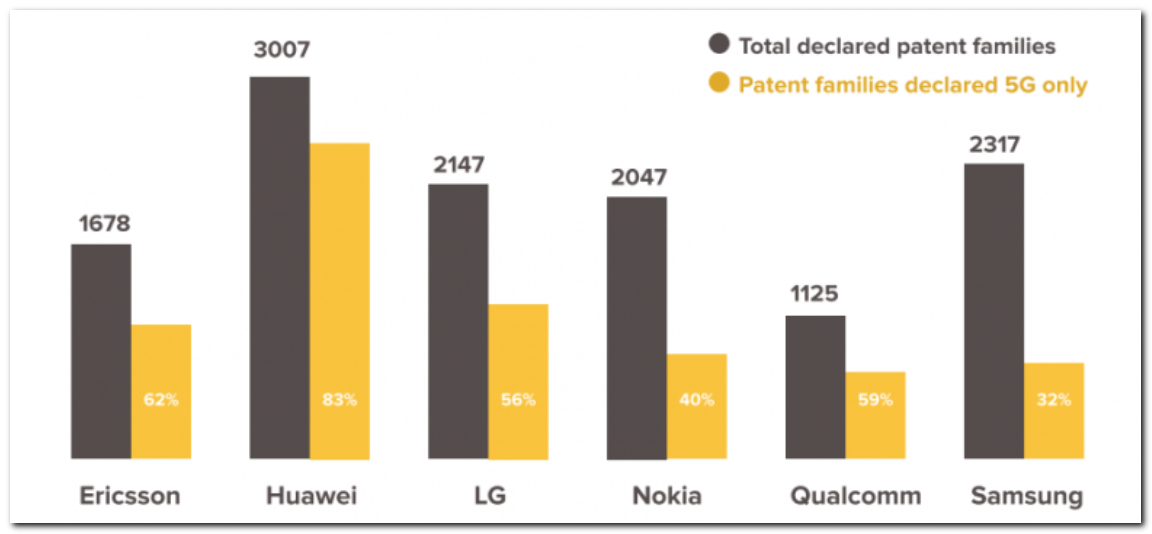

As mentioned above, HUAWEI is the leading name when it comes to the number of 5G patents, and by a big margin. As per technology research and intelligence firm GreyB, HUAWEI had 3,000 declared 5G patent families as of March 2021. It is followed by Samsung (2,317 patent families) and LG (2,147 patent families), with Nokia, Ericsson, and Qualcomm sitting below it. Together, these six companies own 65% of the declared 5G Standard Essential Patent families, while the rest 35% is shared by roughly 70 companies.

Image: GreyB

HUAWEI's 5G patent licensing likely won't be affected by US trade restrictions

“Huawei has been the largest technical contributor to 5G standards, and follows fair, reasonable and non-discriminatory (FRAND) principles when it comes to patent licensing. we hope that the royalty rate we announced today will increase 5G adoption by giving 5G implementers a more transparent cost structure that will inform their investment decisions moving forward,” Deng was quoted as saying.

And in just you’re wondering, the royalty fee charged by HUAWEI for its SEPs won’t likely contradict with terms of trade restrictions that were imposed after HUAWEI was blacklisted and put on the ‘Entity List’ for allegedly being a national security threat. As per a report by Bloomberg, HUAWEI executives have made it clear that those 5G patents are publicly available, which means they don’t necessarily qualify as US-based companies doing business – sale/purchase of products/services – with HUAWEI.