Earlier this month, Google made some changes to its Play Store payment policy, making it clear that all new app submissions made after January 20 next year will have to implement the native Google Play billing system for in-app payments. And apps that currently rely on an alternative billing system have to remove it before September 30, 2021. However, after hearing feedback from the Indian developer community, Google has decided to extend the deadline of its in-app payment mandate until March 31, 2022 for Indian developers. What this means is Indian app developers now have until March 31, 2022 to implement the Google Play billing system in their apps.

“We’re also extending the time for developers in India to integrate with the Play billing system, to ensure they have enough time to implement the UPI for subscription payment option that will be made available on Google Play– for all apps that are yet to launch, or that currently use an alternative payment system, we set a timeline of 31st March 2022,” the company said in a blog post.

In case it is not already clear, the March 31, 2021 deadline for implementing Play Store’s own billing system applies for new app submissions as well as existing apps that currently use an alternative payment system. In addition to extending the deadline, Google also revealed that it is going to set up listening sessions with Indian startups to hear their concerns. Plus, a Policy Workshop will also be started to help resolve queries related to Play Store policies.

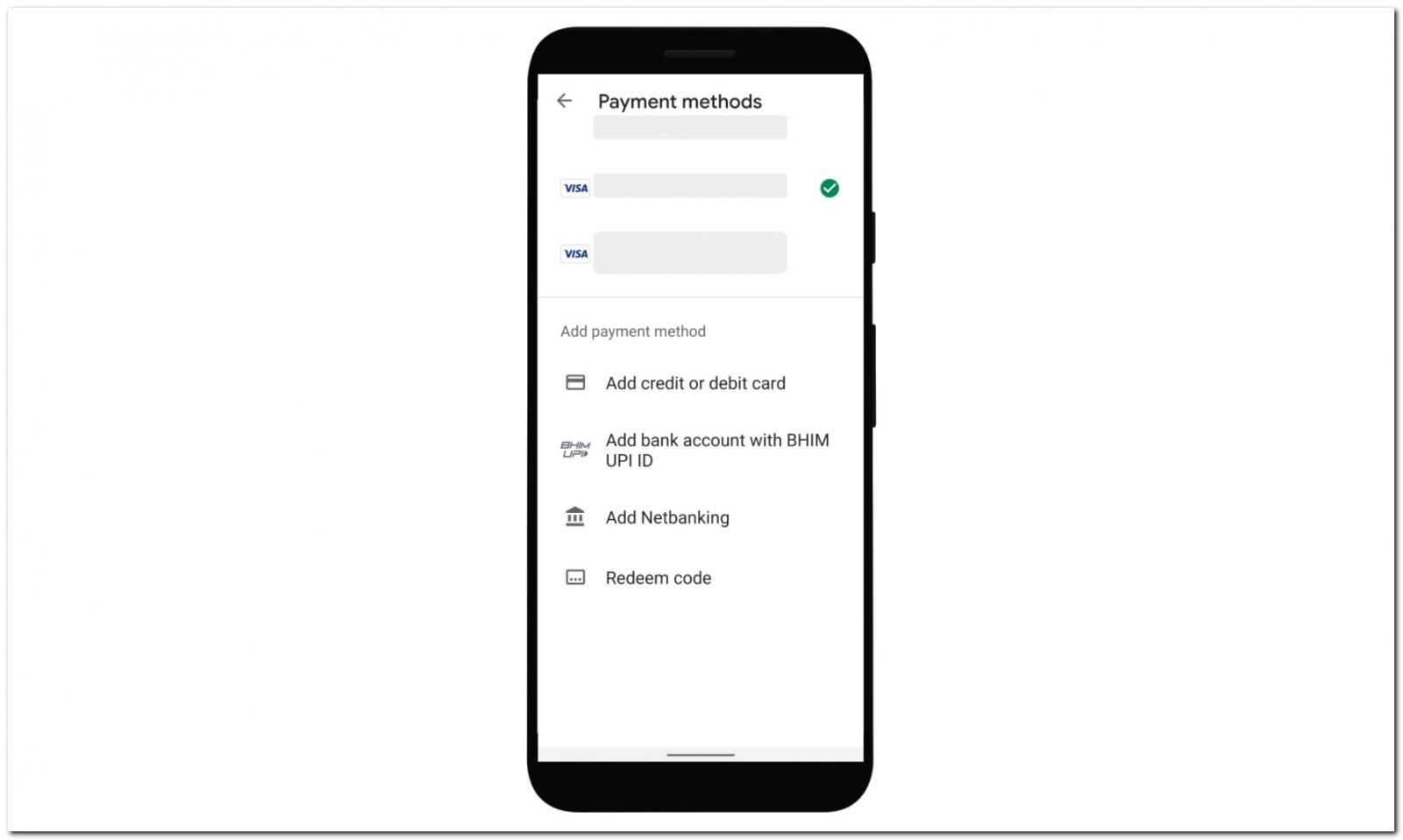

Google also clarified that Google Play billing is not a form of payment. Instead, it is a billing system that accepts various forms of payment (over 290, as per Google) such as credit and debit cards, net banking, carrier billing, gift cards, and even locally developed options such as UPI (Unified Payments Interface). The latter was created by the National Payments Corporation of India to facilitate instant fund transfer via smartphones, and has already been baked inside Google’s own G Pay (or Google Pay) app as well as those from rivals such as Paytm.