T-Mobile might still just be a wireless carrier for now, but it’s been winding its way towards bundling TV services into its offerings. But this next move came right out of left field.

A new Google Pay linked bank listing turned up something called T-Mobile MONEY. Domain Name Wire followed up by checking out a whole bunch of domains that the Un-carrier purchased — a lot of them were typos of “t-mobilemoney.com.”

T-Mobile has yet to officially acknowledge T-Mobile MONEY as of press time. A source tells us that the program is in a pilot stage.

The actual program itself, which is backed by financial tech startup BankMobile, is FDIC-insured — filed as #34444 under the name of parent company Customers Bank — so deposits up to $250,000 are insured.

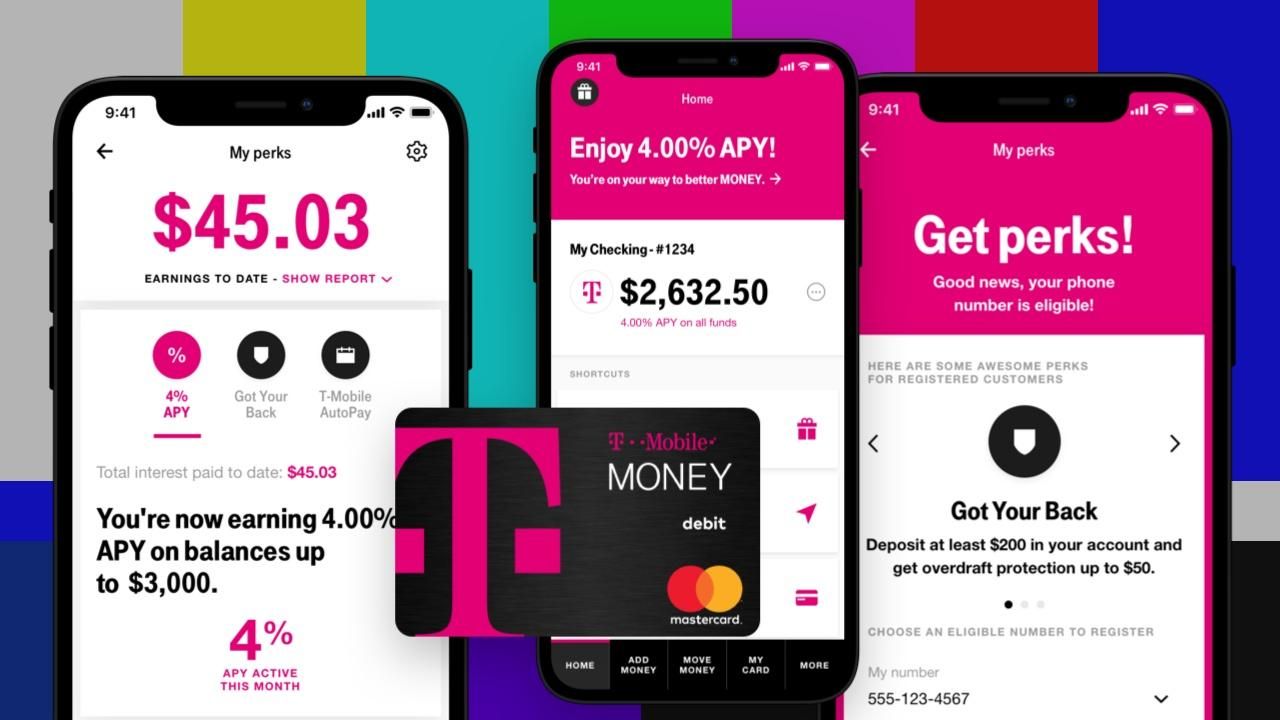

T-Mobile’s top-line offering for all balances is 1 percent annual percentage yield with its postpaid wireless customers getting the best treatment: those who deposit at least $200 a month can earn 4 percent APY on a maximum of $3,000 in a checking account or $10 per month. They also get $50 coverage on overdrafts as long as they zero out the balance within 30 days.

The company does not charge an account fee or require a minimum balance. Customers can use 55,000 Allpoint ATMs fee-free.

Debit cards are issued by Mastercard and can be managed through the T-Mobile MONEY app and site. The card is touted with links to Apple Pay, Google Pay and Samsung Pay. Mobile check depositing and direct deposits can be there. It’s also backed by human customer service 24 hours a day, 7 days a week.

Whether or not you subscribe to T-Mobile for wireless service, you can sign up for T-Mobile MONEY through the Android app, the iOS app or at this link.

This isn’t the first time T-Mobile pursued mobile banking — it had a Mobile Money program until 2016.